As Malaysian businesses continue to evolve in the digital age, the selection of an optimal payment gateway is vital for enhancing customer experience and streamlining transaction processes.

This guide offers an in-depth analysis of the leading payment gateways in Malaysia, providing valuable insights to help business owners make informed decisions.

Introduction to Payment Gateways in Malaysia

In today’s economy, a payment gateway acts as a critical bridge between an online store and the banking system, facilitating secure transactions that enable customers to make payments effortlessly.

For Malaysian businesses, choosing the right payment gateway involves much more than convenience; it also encompasses security, a variety of payment options, and competitive fees.

Key considerations for Malaysian business owners include:

- Security: Ensure the gateway complies with PCI DSS standards to safeguard sensitive information.

- User Experience: A seamless checkout process is essential for reducing cart abandonment rates and enhancing overall sales.

- Integration: The payment gateway should integrate smoothly with existing online platforms, providing a seamless operational flow.

- Fees: Be vigilant about transaction fees, monthly fees, and any hidden costs, as these can significantly impact profitability.

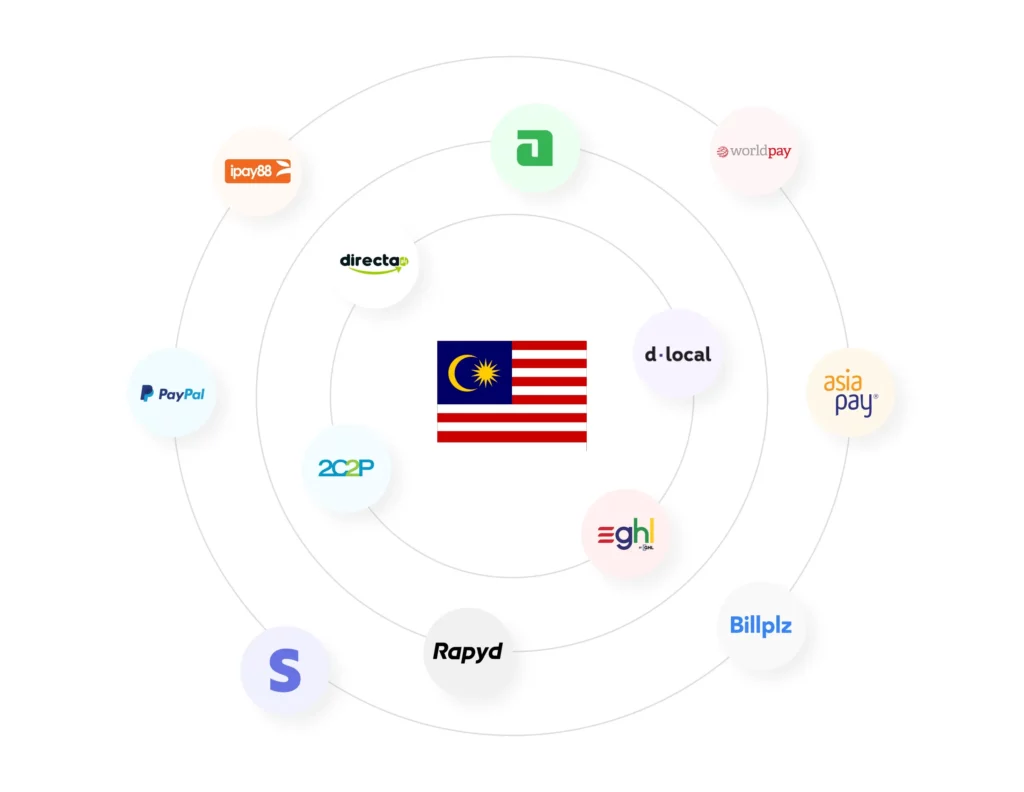

Overview of Popular Payment Gateways in Malaysia

iPay88

iPay88 is a well-established payment gateway that has earned a solid reputation in Malaysia since its launch in 2006. It offers a diverse range of payment options, including credit cards, online banking, and e-wallets.

Key Features:

- Security: iPay88 adheres to PCI DSS compliance, greatly reducing the risk of data breaches.

- Integration: The platform integrates seamlessly with various e-commerce platforms like Shopify and WooCommerce, making implementation straightforward for businesses.

- Customer Support: They provide 24/7 support, allowing for prompt issue resolution crucial for maintaining operational efficiency.

With its comprehensive offerings, iPay88 is a reliable choice for Malaysian e-commerce businesses looking to enhance payment processing.

MOLPay

MOLPay stands strong in the Malaysian payment gateway arena, known for its capability to handle both online and offline transactions effectively.

Key Features:

- Local & International Payments: MOLPay supports multiple currencies, which is vital for businesses expanding their market presence.

- User-Friendly Interface: Its intuitive design simplifies the payment process for both customers and merchants alike.

- Fraud Protection: Built-in fraud detection systems enhance security and instil confidence among users.

MOLPay’s robust features make it an excellent choice for businesses of all sizes looking to streamline their payment processes.

Stripe

Globally renowned, Stripe is rapidly gaining traction in Malaysia, particularly among tech-savvy businesses. It’s celebrated for its advanced technology and flexible payment solutions.

Key Features:

- Customisation: Stripe offers powerful API tools that allow businesses to tailor their payment systems to meet specific needs.

- Recurring Payments: Stripe makes managing subscriptions and recurring billing straightforward, which is essential for SaaS and membership-based businesses.

- E-commerce Excellence: Known for optimising conversions with a superior payment experience, it fits perfectly within competitive markets.

For Malaysian businesses intent on enhancing their online payment systems, Stripe is a formidable option.

ToyyibPay

ToyyibPay has emerged as a fantastic option for small and medium-sized enterprises in Malaysia, with a strong focus on affordability and accessibility.

Key Features:

- Affordability: With low transaction fees and no setup costs, ToyyibPay is an attractive choice for startups.

- User-Friendly Interface: It is designed specifically for local businesses, promoting a straightforward payment experience.

- Payment Links: This feature allows merchants to generate shareable payment links, making transactions more convenient for customers.

ToyyibPay’s focus on cost-effectiveness makes it particularly appealing for entrepreneurs looking to establish strong payment solutions without burdening initial cash flow.

PayPal

As a leading global payment platform, Malaysian businesses often choose PayPal for international transactions. Its longstanding reputation provides buyers with an extra layer of trust.

Key Features:

- Trust Factor: Its global recognition enables customers to feel secure when purchasing, increasing conversion rates.

- Multiple Payment Options: Supports a wide array of payment methods, including credit cards, bank transfers, and PayPal balances.

- Chargeback Protection: Offers buyer and seller protection policies, mitigating the risks tied to online transactions.

While PayPal has higher transaction fees, its extensive global reach and trustworthiness render it invaluable for international market engagement.

Billplz

Billplz is dedicated to simplicity and cost-effectiveness, catering primarily to small businesses and freelancers. It stands out in the Malaysian landscape for its straightforward approach to payments.

Key Features:

- Low Fees: Billplz offers competitive flat-rate pricing, making it ideal for businesses with lower transaction volumes.

- Quick Settlement: Transactions are processed swiftly, allowing businesses to access funds without delay, which is vital for effective cash flow management.

- Integration Options: Easily integrates with various local e-commerce platforms, adding much-needed flexibility.

Billplz is an ideal choice for businesses looking to adopt a straightforward payment solution without high overhead costs.

Fiuu (formerly Razer Merchant Services)

Fiuu, previously known as Razer Merchant Services, has positioned itself as a prominent player in the Malaysian payment gateway market, particularly appealing to the gaming and entertainment sectors. Fiuu aims to empower businesses with innovative payment solutions tailored to meet modern consumer needs.

Key Features:

- Comprehensive Payment Methods: Fiuu supports a wide array of payment options, including local and international credit cards, e-wallets, and cash payments via partnered stores.

- Advanced Security Features: The platform is equipped with cutting-edge fraud management tools that elevate security and protect merchants from fraudulent transactions.

- Analytics Dashboard: Provides merchants with valuable insights into transaction patterns, helping businesses understand customer behaviour and optimize their services.

Fiuu is an excellent choice for businesses in tech-driven sectors looking for tailored payment solutions that fit their specific operational requirements.

Touch ‘n Go eWallet

Touch ‘n Go has expanded its offerings to include a fully-fledged payment gateway, gaining popularity among consumers for its ease of use and extensive acceptance.

Key Features:

- Widespread Acceptance: Touch ‘n Go eWallet is accepted at numerous merchants across Malaysia, enhancing businesses’ consumer base.

- Easy Integration: Businesses can integrate it with their POS systems and e-commerce platforms easily, offering a seamless experience.

- Promotions & Rewards: Various promotions and cashback offers incentivise consumers to use the eWallet, benefitting businesses through increased sales volumes.

Touch ‘n Go is perfect for businesses aiming to tap into a customer base that prioritises mobile payments.

Maybank QRPay

Maybank’s QRPay platform allows customers to conduct transactions using QR codes, which enhances the speed and efficiency of payments at retail points.

Key Features:

- Instant Payments: QRPay processes transactions instantly, improving customer experience by reducing wait times.

- Simplified Transactions: The QR code system is straightforward and requires minimal employee training, making it user-friendly for all types of businesses.

- Strong Security: Maybank implements robust security measures, including encryption and transaction tracking.

Maybank QRPay is highly beneficial for businesses looking to modernise their payment options and streamline their transaction processes.

Comparing Fees and Charges

Understanding the fee structures is crucial when selecting a payment gateway. Here’s a summary of the latest fees for the top payment gateways in Malaysia:

| Payment Gateway | Transaction Fee | Monthly Fee | Chargeback Fee |

|---|---|---|---|

| iPay88 | 2.8% to 3.2% + RM0.60 | RM0 | RM30 |

| MOLPay | 2.0% + RM1.00 | RM0 | RM30 |

| Stripe | 2.9% + RM0.50 | RM0 | RM15 |

| ToyyibPay | 1.5% + RM0.50 | RM0 | RM30 |

| PayPal | 3.9% + RM2.00 | RM0 | RM15 |

| Billplz | RM1.20 per transaction | RM0 | None |

| Fiuu | 3.0% + RM1.00 | RM0 | RM30 |

| Touch ‘n Go eWallet | 1.0% | RM0 | RM30 |

| Maybank QRPay | 1.5% | RM0 | RM20 |

With these updated figures, Malaysian business owners can make better-informed decisions regarding which payment gateway aligns with their financial objectives.

Security Features to Consider

In an era where online transactions are commonplace, security is paramount for protecting customers and maintaining their trust. Malaysian businesses must seek gateways that offer robust security measures, such as:

- Encryption: Ensures that data remains secure during transmission, safeguarding sensitive information.

- Fraud Prevention Tools: Advanced tools that monitor transactions for suspicious activities, minimising the risk of fraud and chargebacks.

- Tokenisation: Converts sensitive data into tokens, ensuring that customer information remains secure.

Implementing secure payment solutions not only fosters customer loyalty but also protects the integrity and reputation of the business.

Customer Support and Service

Efficient customer support can significantly influence operational effectiveness and overall customer satisfaction. Payment gateways should ideally provide:

- 24/7 Support: Essential for promptly addressing issues and minimising any disruptions to business operations.

- Multi-lingual Assistance: Important in Malaysia’s diverse linguistic landscape, allowing for better service and communication with a wider audience.

- Comprehensive Resources: The availability of tutorials, FAQs, and community forums empowers business owners and assists in informed decision-making.

Reliable customer support is indispensable in navigating the complexities of payment processing, ensuring that any issues can be quickly addressed.

Final Thoughts

Choosing the right payment gateway is a strategic decision for Malaysian business owners seeking to thrive in a dynamic market. We recommend evaluating each option based on specific business needs, transaction volumes, and customer preferences. Doing so will enhance the payment experience for customers and foster long-term loyalty.

Conclusion

Payment gateways serve as the backbone of e-commerce transactions in Malaysia. By carefully evaluating features, fees, security measures, and customer support, businesses can select the ideal partner for their payment processing needs.

Armed with the insights from this guide, you can navigate the evolving landscape of digital payments effectively, ensuring a seamless, secure payment experience for your customers.

FAQ Related to Payment Gateways Malaysia

1. What is a payment gateway, and why is it important for my business?

A payment gateway is a service that facilitates online transactions by processing customer payments securely between your website and the bank. It’s essential for businesses as it enables smooth and secure payment processing, enhances customer trust, and can improve conversion rates by offering various payment methods.

2. How do I choose the right payment gateway for my business in Malaysia?

When selecting a payment gateway, consider factors such as transaction fees, integration capabilities with your existing e-commerce platform, security features like PCI DSS compliance, customer support availability, and various payment methods. Assessing these criteria will help you choose a gateway that fits your specific business needs.

3. What are the typical fees associated with payment gateways in Malaysia?

Payment gateways often charge transaction fees (which can vary based on the amount and type of transaction), monthly fees, and sometimes chargeback fees. For example, transaction fees in Malaysia can range from around 1% to 3.9%, depending on the provider and transaction method.

4. Are payment gateways in Malaysia secure for online transactions?

Yes, reputable payment gateways in Malaysia implement robust security measures, including encryption, fraud detection systems, and compliance with PCI DSS standards. These protocols are designed to protect sensitive customer information during transactions, ensuring a secure payment experience.

5. Can I integrate multiple payment gateways into my e-commerce platform?

Yes, most e-commerce platforms allow for the integration of multiple payment gateways. This flexibility enables businesses to offer customers various payment options, which can improve the customer experience and potentially increase sales. However, ensure that your chosen platforms are compatible with the payment gateways you wish to use.